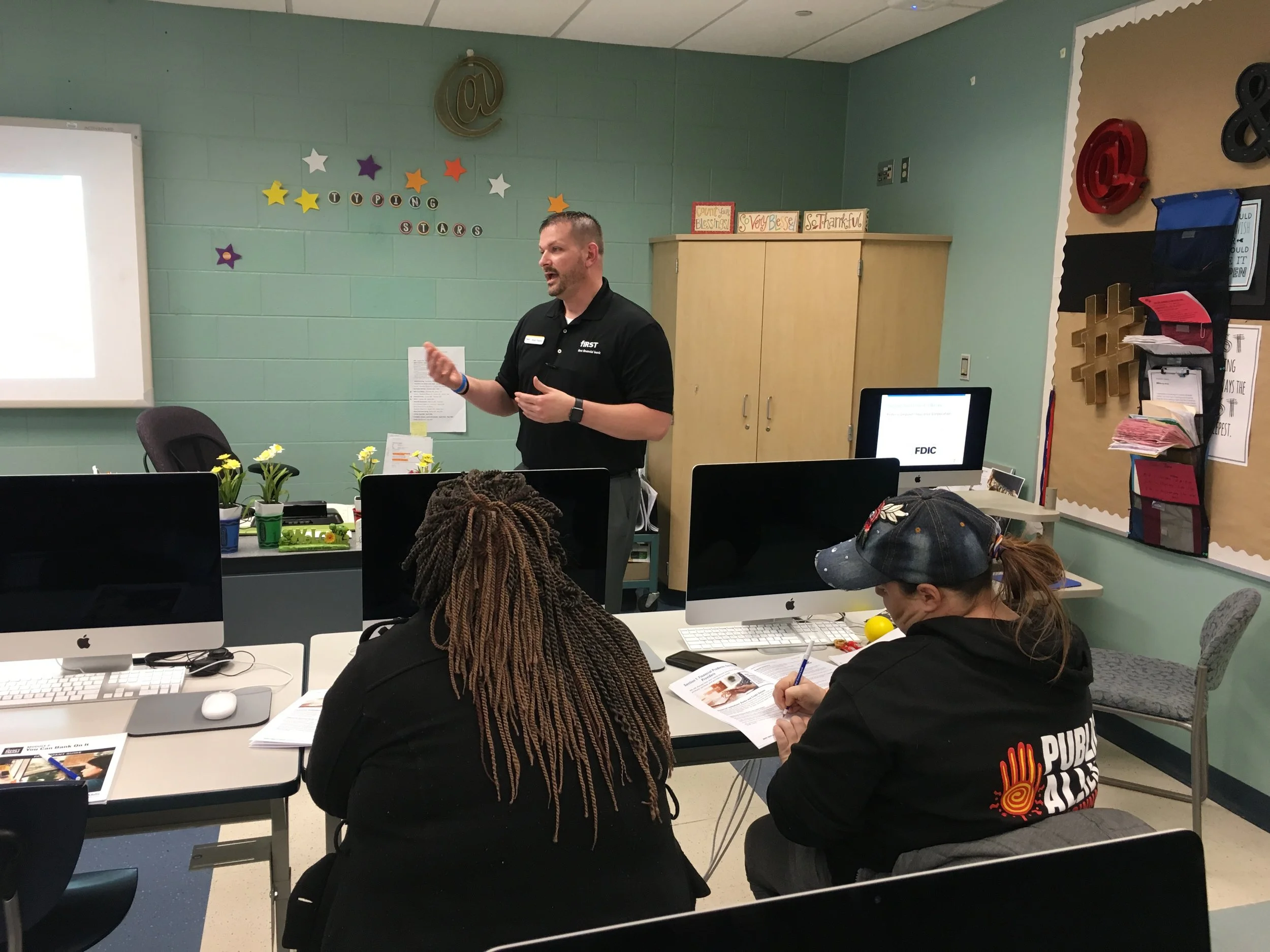

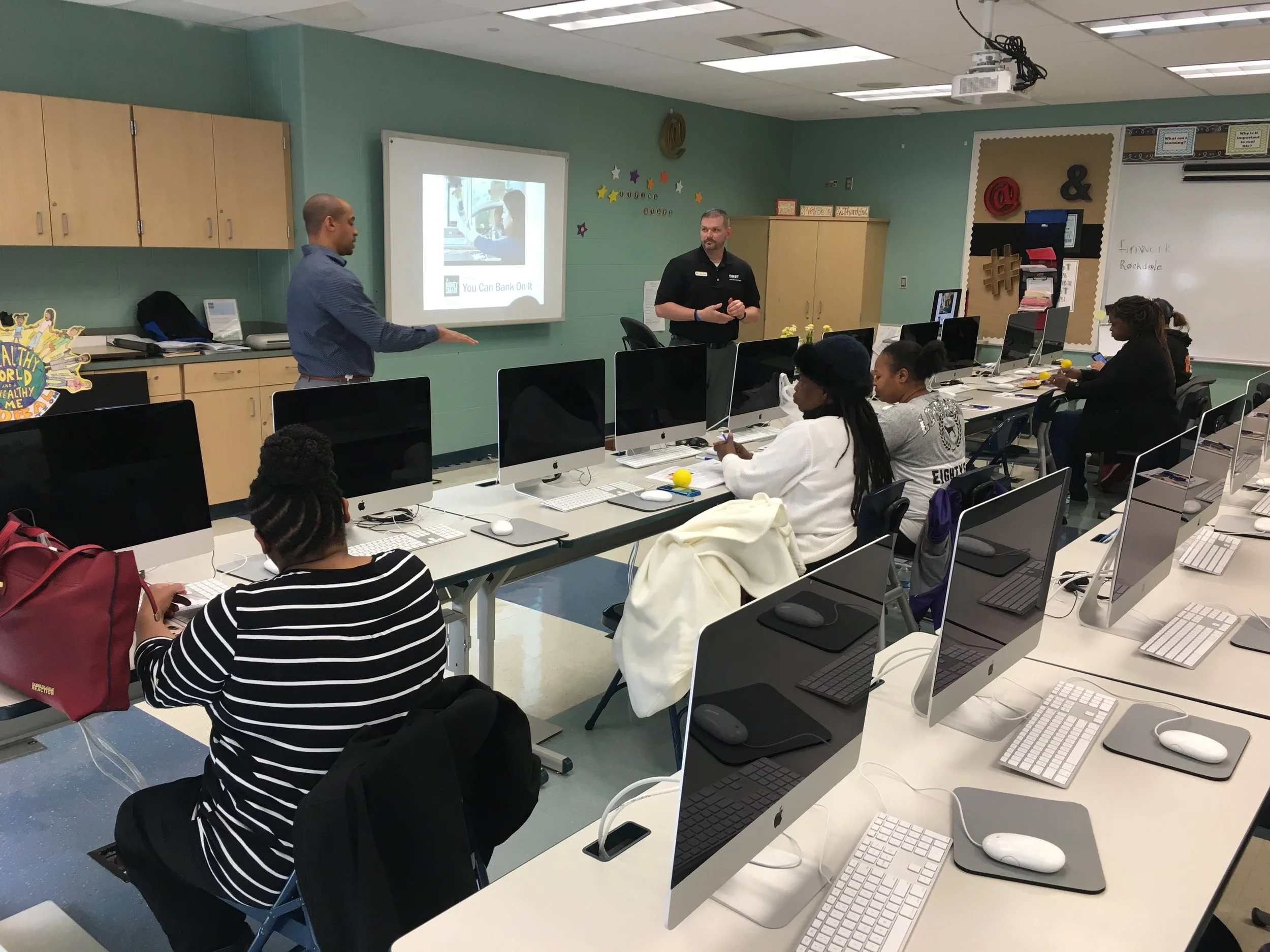

On March 7, with support from Greater Cincinnati Foundation, the Avondale Development Corporation (ADC) and Uptown Consortium kicked off a new workshop series, “Adult Personal Financial Education.” The five-part program facilitated by First Financial Bank runs through April 4, offering residents the tools to obtain greater fiscal freedom.

Each course has a different focus, giving participants a thorough understanding of banking essentials. Sessions dive into topics such as checking accounts, budgeting, saving and investing. While financial literacy is the overarching goal, there is an emphasis on home ownership.

“We’re trying to increase home ownership in Avondale, but we’re also trying to make sure that existing residents are a part of that increase,” said Patrick Cartier, Community Engagement and Communications Manager at ADC. “We want our residents to take advantage of the development that’s going on in the community.”

Cartier works directly with Avondale residents and helped tailor the program to the needs of the community.

“We did a SWAT (Strength, Weakness, Opportunity, Threat) analysis with 200 different Avondale residents last summer, and the results told us that residents want to become homeowners and become more financially literate,” said Cartier.

Housing and home ownership are among ADC’s top priorities as part of its Avondale Quality of Life Plan. The organization is using data from a housing market assessment prepared by Dinn Focused Marketing, Inc. for Uptown Consortium in 2018.

“We want to provide opportunities for Avondale residents to grow with the neighborhood, including job, investing and homeownership opportunities,” said Brooke Duncan, Community Development Manager of Uptown Consortium. “We’re happy to work with ADC to make this series possible.”

Cartier has built close relationships with many residents throughout his eight years working with ADC, and he said that the workshop has been rewarding for him and for the participants.

“A few of the participants come from low-income housing, so seeing them take steps toward becoming homeowners is wonderful,” said Cartier. “We’re just trying to provide residents with the right resources. We want to give them the extra push they need to get there.”

The intimate workshop setting also offers participants the opportunity to air concerns and problems they’ve had financially in the past. Onsite banking professionals from First Financial Bank provide realistic, tailored and individualized advice to the attendees.

“They talked about different things and taught us how to save, how to get a deposit, how to get our credit score together,” said a participant. “I mean, this is great. I love it.”

The goal of the five-week program is for Avondale residents get to walk away feeling more confident about managing money, using credit wisely, and overcoming debt. Based on the workshop’s success, Cartier hopes to organize a second workshop series in the future.

“I have been telling everybody about the class,” said another participant. “If it comes back around, take advantage of it, because they gave some powerful information that you can use, especially for the ladies in this class that are ready to buy a house.”

Anyone who is interested in participating in future workshops can visit the Avondale Development Corporation website or contact Patrick Cartier.